MARCH 15, 2023 / at 4:28 PM PDT / KWTX

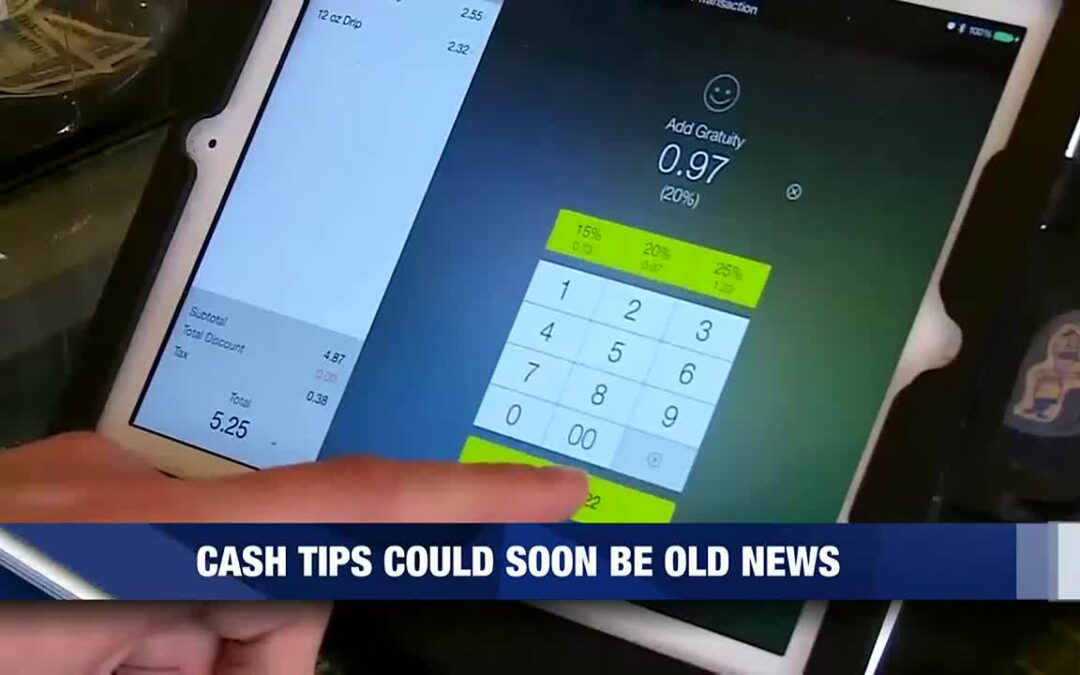

WACO, Texas (KWTX) – The opportunity to leave a monetary tip for service is becoming more apparent when out shopping, and the IRS has taken notice.

It’s called the service industry tip compliance agreement, or S.I.T.C.A. for short, and it could change the way merchants receive tips.

As it stands now, when a card is used to pay, that information is sent to the IRS, automatically, even if you leave an unreported cash tip.

“The IRS uses what comes through cash registers and gets reported on credit cards, and that sort of thing, and then estimates the cash. They’ve been doing that for years,” said economist Ray Perryman.

What’s changing is that the point-of-sale system used would have to accept the same form of payment for tips as it does for sales.

This means card payments require card tips and cash payments require cash tips. No more paying with a card and tipping in cash.

“Our employees by law have to report 100% of their tips and our system makes them report that,” said popular Waco restaurant owner, Sammy Citrano.

Citrano owns one of the most popular destinations in the Waco area.

To keep it that way, he ensures his employees report all their earnings, including tips.

“I don’t think it’d affect our people because we already pay all of the taxes on our tips,” said Citrano.

If you’re not reporting your tips already, heads up, that time is coming.

Any business or employee that continues to omit tip earnings can expect a visit from the IRS or a hefty tax bill.

“You’re going to be in one of the flags that they catch people and pretty likely audit them,” said Perryman.

The IRS claims this new program is just a part of modernizing how they receive information from merchants.

Times are changing for payment acceptance and the IRS wants to adapt, at the risk of losing cash tips.

Original Article can be found here.